You’ve reached your limit!

To continue enjoying Utility Week Innovate, brought to you in association with Utility Week Live or gain unlimited Utility Week site access choose the option that applies to you below:

Register to access Utility Week Innovate

- Get the latest insight on frontline business challenges

- Receive specialist sector newsletters to keep you informed

- Access our Utility Week Innovate content for free

- Join us in bringing collaborative innovation to life at Utility Week Live

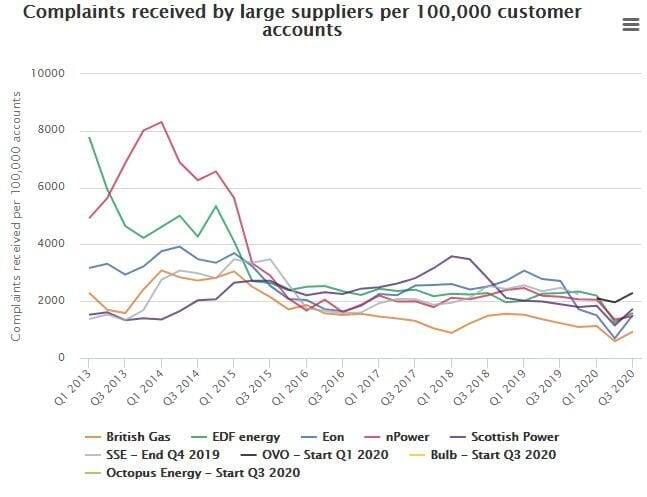

Ovo Energy received more complaints per 100,000 customers than any other supplier in the energy sector’s latest scorecard by the UK Regulators Networks (UKRN).

Beginning last year, UKRN publishes annual scorecards for four sectors: Energy, water, telecoms and finance.

The scorecards examine key consumer metrics covering service quality, price differentials and satisfaction levels.

Information in the scorecard for energy was collected by Ofgem in Q3 and Q4 2020 and compared to the same time in 2019, the total volume of complaints received by suppliers decreased.

Topping the list with 2,293 complaints per 100,000 in Q3 is Ovo Energy, which also includes the customers of SSE which it acquired in January last year, as well as those of Boost and Spark Energy.

Not far behind is Shell Energy which received 2,247. After acquiring Hudson Energy Supply, including its domestic retail arm Green Star Energy, Shell migrated 200,000 retail customers over to its platform last year.

In response a spokesperson for Ovo said: “We’re disappointed not to meet our usual high standards for our customers. We’re always looking for ways to improve and will be taking steps throughout this year.”

Meanwhile a Shell Energy spokesperson said the retailer was “100 per cent committed” to its customers and that the company supports the journey to net zero carbon emissions.

“We apologise to those customers who have felt let down by the service and our focus remains on improving the experience for all our customers”, they added.

In contrast Octopus Energy received 565 complaints per 100,000, making it the best performing large supplier. British Gas also fared well with 926.

Overall satisfaction and NPS

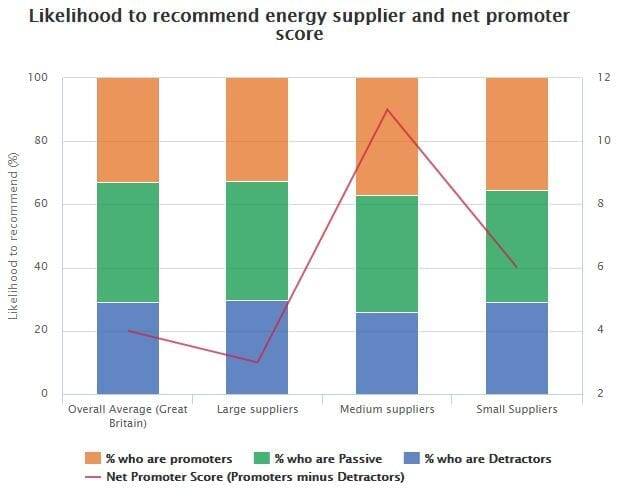

Overall customer satisfaction levels with suppliers in Great Britain range between 75-80 per cent, with an average score of 76 per cent.

This is an improvement from the previous year which saw the sector score a 74 per cent average.

Small suppliers were the most highly rated at 80 per cent, while medium and large scored 77 per cent and 75 per cent respectively.

Meanwhile for the overall sector 33 per cent said they were likely to recommend their supplier, 38 per cent were passive while 29 per cent were detractors.

This means that the sector’s overall Net Promoter Score (NPS), which is the number of promoters minus the number of detractors, is 4. UKRN said any score above 0 is considered ‘good’, while any score above 50 is considered ‘excellent’.

Medium suppliers received the best NPS score (11) while large suppliers received the worst (3). Small suppliers were given a score of 6.

Responding to the survey Philippa Pickford, director of retail at Ofgem, said “During Covid-19 we have worked closely with other regulators via the UKRN to share knowledge on the impacts on consumers in different sectors and the actions we took to address Covid-19 challenges.

“We will continue this knowledge sharing and take joint action where this is possible and there are clear consumer benefits. We continue to work closely with other regulators through the UKRN to further improve collaboration.”

Please login or Register to leave a comment.